With the rapid increase in global data traffic, the demand for high-performance AI server clusters has surged, driving significant growth in the need for optical transceivers.

Currently, the trend towards higher-speed optical transceivers is becoming increasingly evident in both the telecommunications and data communications sectors. NADDOD consistently stands at the forefront, providing high-speed optical transceivers (IB 800G/400G, RoCE 800G/400G) that ensure low-latency network performance, energy efficiency, and reliability.

1. Evolution of Optical Transceivers from 400G to 800G

Optical transceivers are used in fiber optic communications to convert electrical signals to optical signals at the transmission end and vice versa at the receiving end.

The average iteration cycle for data communication optical transceivers is about 3-4 years. For example, 100G transceivers started gaining traction in 2016 and had a lifecycle of about 5 years by 2021. It is expected that the lifecycle of 400G transceivers will also reach 4-5 years.

As the speed of switching chips continues to increase, the demand for optical transceivers is also evolving.

Theoretically, when switching chip speeds reach 51.2Tbps, 400G optical transceivers will become mainstream, with the initial demand for 800G transceivers emerging.

As switching chip speeds further increase to 102.4Tbps, 800G optical transceivers will replace 400G as the new mainstream, with the demand for 1.6T transceivers beginning to emerge.

NADDOD, a leading optical transceiver manufacturer, offers a wide range of high-speed transceivers, including IB transceivers (400G/800G NDR, 200G HDR, and 100G EDR), and transceivers that apply in RoCE architecture, as well as DACs and AOCs, to meet diverse networking needs.

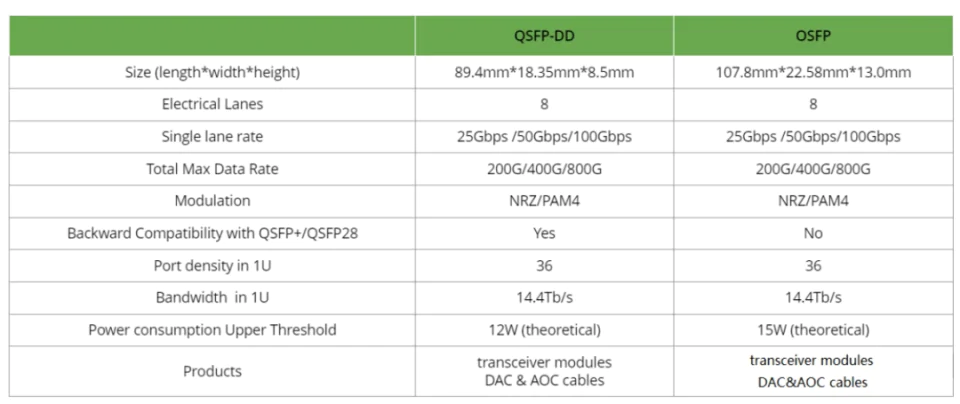

Difference between QSFP-DD and OSFP

Difference between QSFP-DD and OSFP

2. NVIDIA Accelerates Demand for Optical Transceivers

NVIDIA's GPUs play a crucial role in AI development, providing essential computational power. The close integration of GPUs and optical transceivers has further enhanced data transmission speeds and computing capabilities for AI training.

With the significant increase in NVIDIA GPU shipments, the optical transceiver industry is experiencing growth in both volume and price. Fierce competition among tech companies is driving the demand for GPUs. For example, Meta's purchase of H100 GPUs exceeded market expectations, and both Microsoft and Google plan to increase their GPU purchases. As a result, the optical transceiver industry is benefiting from the GPU boom. Since Meta began purchasing more GPUs, leading optical transceiver companies have scheduled production orders through the second quarter of 2024.

NVIDIA is also driving the demand for high-end optical transceivers. With the increasing bandwidth demands of AI, higher-speed transceivers are becoming necessary. NVIDIA's latest H100 chips increasingly use 800G optical transceivers, further boosting their sales.

AMD recently highlighted the expected market size of $400 billion for computational chips by 2027, and Coherent has raised the CAGR forecast for the 800G and above transceiver market to 65% through 2028.

The emergence of AI-generated video technology also presents new opportunities for the optical transceiver industry. Longer, higher-definition, and more detailed video generation requires higher transmission speeds and stability from optical transceivers. This trend is further driving the sales of 800G transceivers. By 2024, NVIDIA alone is expected to support a market demand of 10 million 800G transceivers.

3. Optical Transceivers Market Landscape

The latest analysis from LightCounting highlights significant trends and shifts in the optical transceiver market, driven by the rapid expansion of AI clusters and the growing demand for high-speed data connectivity. Leading cloud companies like Amazon, Google, and Meta are heavily investing in AI infrastructure and interconnecting them with private metro, long haul, and undersea networks to support their business growth. The sheer scale of their demand for networking equipment and optical connectivity makes each of these companies a distinct market segment.

In 2023, NVIDIA emerged as a notable new market segment. Key suppliers to NVIDIA, such as TFC, Innolight, Fabrinet, and Coherent, reported revenue growth, highlighting NVIDIA's significant impact on the market. In contrast, other suppliers of optical components and modules, tracked by LightCounting, saw declines in revenues for the same period and have yet to establish collaborations with NVIDIA.

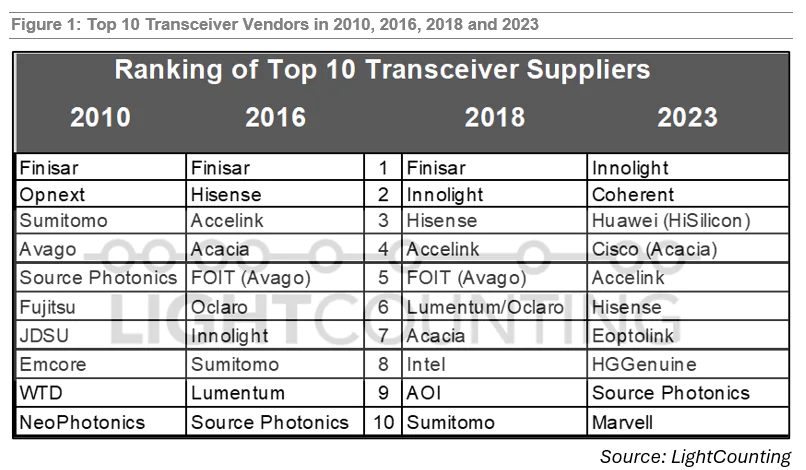

TOP10 list of optical transceiver suppliers

The evolution of the top 10 list of optical transceiver suppliers over the last decade illustrates a shift in market dynamics. Many Japanese and US-based suppliers exited the market by 2018, while Chinese vendors, led by Innolight, ascended the rankings. For the first time in 2023, Innolight topped the list, with Coherent (formerly Finisar) in second place. These two companies shared the top spot in 2021 and 2022, but Coherent's greater exposure to the declining telecom segment affected its position in 2023.

LightCounting's report provides an in-depth analysis of vendor rankings and their positions in different market segments for 2022-2023. It examines the business strategies of telecom service providers and cloud companies, along with their suppliers of networking equipment, optical, and electronic components.

NADDOD, leveraging its advanced manufacturing capabilities and strong R&D, is strategically positioned in this competitive landscape. Offering a diverse range of high-speed transceivers, NADDOD addresses the varied networking needs of modern data centers. The company’s unwavering commitment to quality and innovation ensures it remains a preferred partner for leading technology companies, delivering reliable, high-performance solutions that meet the evolving demands of the market.

4. High-Speed Optical Transceivers are the Trend

As optical transceivers continue to advance, the rapid development towards 800G has become an industry consensus, and the trend towards 1.6T high-speed evolution is becoming increasingly apparent.

A transmission rate of 1.6T, or 200G per channel, can be achieved through the parallel transmission of eight channels, doubling the rate of 800G. For AI customers, this means transmitting more data in a shorter time, improving data processing efficiency.

In the journey towards the 1.6T era, traditional pluggable rate upgrades may reach their limits, leading to a shift towards co-packaged optics (CPO) and related solutions. According to LightCounting, CPO shipments are expected to start with 800G and 1.6T ports, with commercial availability projected between 2024 and 2025, and large-scale production expected between 2026 and 2027.

AI has significantly accelerated the iteration of optical transceiver technology, shortening update cycles. Some optical transceiver manufacturers have already made breakthroughs in 1.6T transceiver technology.

Silicon photonics technology is also expected to be widely used in GPU interconnects, next-generation NVLink, and CPO silicon photonic engines, further driving the upgrade from 800G to 1.6T high-speed transceivers.

According to LightCounting's forecast report released in July 2023, the market size for optical transceivers used in AI cluster applications is expected to reach $17.6 billion from 2023 to 2027, accounting for 38% of the overall optical transceiver market during the same period.

Due to the higher bandwidth demands of AI large models, high-speed optical transceivers (800G and above) offer greater bandwidth and lower power consumption per unit compared to 200G/400G transceivers. Therefore, the demand growth rate for high-speed optical transceivers is expected to be higher.

Coherent predicts that the data communication transceiver market for 800G, 1.6T, and 3.2T will grow at a CAGR of over 40% in the next five years, increasing from $600 million in 2023 to $4.2 billion in 2028.

By 2028, or possibly even earlier, AI-related 800G and 1.6T data communication transceivers are expected to account for nearly 40% of shipments.

5. Conclusion

The demand for computing power driven by large AI models continues to grow, but the current supply still falls short of meeting this demand.

In 2024, it is anticipated that computing power chips will undergo continuous technological upgrades to enhance performance and optimize costs, with significant progress expected in GPUs and AI-specific chips developed by cloud service providers.

In the field of optical transceivers, the core development trend is towards higher speeds, lower costs, and reduced power consumption, including LPO, CPO technology, and silicon photonics integration.

Leading optical transceiver manufacturers like NADDOD are poised to capitalize on these opportunities, leveraging their advanced technologies and robust supply chains to meet the evolving needs of the global market. With a focus on innovation, efficiency, and sustainability, NADDOD is well-positioned to support the future growth of data-intensive applications and the AI-driven transformation of industries.

800GBASE-2xSR4 OSFP PAM4 850nm 50m MMF Module

800GBASE-2xSR4 OSFP PAM4 850nm 50m MMF Module- 1PFC Flow Control Technology and Challenges in RoCEv2 Network Deployment

- 2RoCE's Application in High-Performance Computing

- 3Detailed Guide to QSFP112 400G Transceivers and Their Connectivity Advantages

- 4NADDOD 1.6T XDR Infiniband Module: Proven Compatibility with NVIDIA Quantum-X800 Switch

- 5Vera Rubin Superchip - Transformative Force in Accelerated AI Compute