Silicon photonics is a new generation of technology based on silicon and silicon-based substrate materials (e.g. SiGe/Si, SOI, etc.) for the development and integration of optical devices using existing CMOS processes. The core concept is “optics instead of electricity”, i.e., the use of laser beams instead of electronic signals to transmit data, and the integration of optical devices and electronic components into a single microchip. Silicon has low power consumption, high integration and high speed characteristics, is the key technology choice in the Post-Moore era. At present, although the transceiver of silicon-optical solution can not completely replace the traditional solution, the supply share will be greatly increased, the corresponding market scale can be expected and give new entrants a certain opportunity to overtake.

Digital Short-range Silicon Optical Transceiver has Achieved Local Commercial Success

Current applications of silicon photonics include.

- Digital pass short range transceivers.

- Coherent transmission transceivers.

- Co-Packaged Optics (CPO) short distance field of data communication, the application of silicon optical technology to open a new path to reduce costs and improve efficiency

As customers’ requirements for transmission rate, cost, size and power consumption of pluggable transceivers continue to rise, new packaging forms are beginning to emerge. For example, 100G PSM4 and CWDM4 transceivers using silicon-optical processes have achieved a certain degree of commercial adoption with lower BOM costs compared to traditional discrete packages. Although silicon optical transceivers are not recognized by all downstream vendors, the application of silicon optical technology opens a new path for optical interconnection to reduce costs and improve efficiency.

At present, the most important application of silicon optical products is still data centers, 100G digital silicon optical transceiver scheme has matured into a steady phase of shipment, 400G begins to move from small volumes in 2020 to large volumes in 2022, silicon optical transceiver future can be expected.

Short-range 400G Silicon Optical transceiver Penetration

The industry’s expectations for the silicon optical transceiver of data communication mainly come from two aspects: cost and power consumption.

- Cost: To achieve a shared optical source architecture with parallel multiplexing, saving device costs; Silicon materials are cheaper than III-V compound semiconductor materials; It is expected to take advantage of CMOS process scale.

- Power consumption: Silicon material impedance is low, the drive voltage is low and its power consumption is also relatively low.

- Integration: Compared to the traditional discrete device package, the same number of optical channels, smaller size.

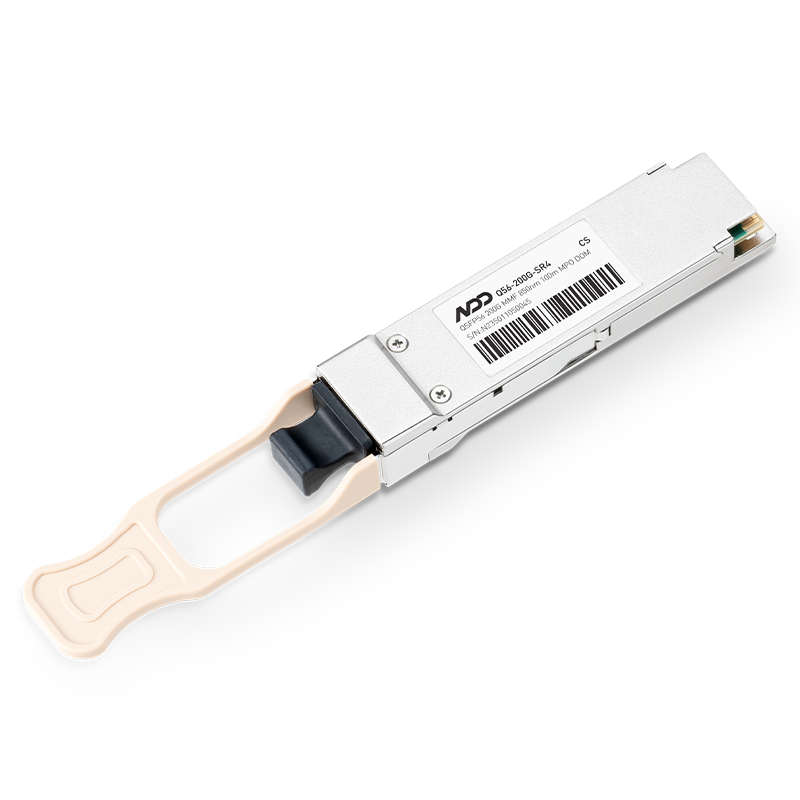

Taking NADDOD 400G DR4 silicon optical transceiver as an example, the silicon optical packaging can share a optical source without EA modulation, and the BOM cost of the optical transceiver can be reduced effectively compared with the traditional scheme of four EML chips. Higher device integration also means that packaging yield can be achieved more quickly.

In the next 2-3 years, the penetration of 400G silicon may be difficult to exceed the same period of 100G silicon. The core reason is that the amount of 400G DR4 or less than 100G CWDM4 + PSM4 is mainly applied in the background of upgrading path differentiation.

Data communication upgrade rhythm is different, there will be ample time in pluggable.

The upgrade path of 400G of data communication is divided into “high, medium and low”, and the rise of 200G solution: from the application point of view, high-performance computing, AI, machine learning and other large bandwidth applications are still on the eve of the explosion. Due to the different needs of different Internet customers for IT load and the urgency of bandwidth upgrade, the upgrade from data communication 100G to 400G is divided into three paths.

- High configuration: Upgrade server port rates to 50G, TOR and spine leaf switches to 400G.

- Medium configuration: First upgrade the spine switch to 400G and connect the 100G TOR with breakout solution, keeping the server and TOR unchanged.

- Low configuration: Upgrade to 200G as a transition, then upgrade to 400G or 800G.

The overall upgrade rhythm has slowed down significantly compared with the 100G era, and the 200G solution may rise to replace part of the 400G demand.

The different upgrade rhythm makes the transceiver life cycle longer, and transceiver manufacturers have more time to cope with the changes: the upgrade rhythm of the past data communication is faster, while the upgrade rhythm may be differentiated after entering the 400G+ era, which may bring more demand for replacement of stock transceivers (the product life of data communication optical transceivers is about 3-5 years) and lengthen the overall product life cycle of pluggable transceivers, giving traditional transceiver manufacturers more time and capital to respond to CPO and other major industry technology changes.

Overall, the silicon optical market has just started, the future market has huge variables. There are certain opportunities for new entrants, and the silicon optical industry has a broad development potential. With 5G entering the large-scale construction phase, the transmission network expansion of new investment continues to rise, the high-speed optical transceiver market is coming.

800GBASE-2xSR4 OSFP PAM4 850nm 50m MMF Module

800GBASE-2xSR4 OSFP PAM4 850nm 50m MMF Module- 1NADDOD 100G Optical Transceiver Enables New Infrastructure for 5G and Data Centers

- 2The Solution of Optical Transceiver Connection Failure Between Data Center Switches

- 3Development Trend of Optical Transceiver Data Communication Market

- 4Inside DeepSeek's 10,000 GPU Cluster: How to Balance Efficiency and Performance in Network Architecture

- 5NADDOD Delivers the First 400G OSFP-RHS SR8 Module to the Market